Gross pay to hourly calculator

This calculator is for you. Gross Pay Hourly Formula.

Pay Raise Calculator

The PAYE Calculator will auto calculate your saved Main gross salary.

. All other pay frequency inputs are assumed to be holidays and vacation. How to calculate annual income. The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period.

For example if an employee receives 500 in take-home pay this calculator can be used to. Try out the take-home calculator choose the 202223 tax year and see how it affects. Your employer withholds a 62 Social Security tax and a.

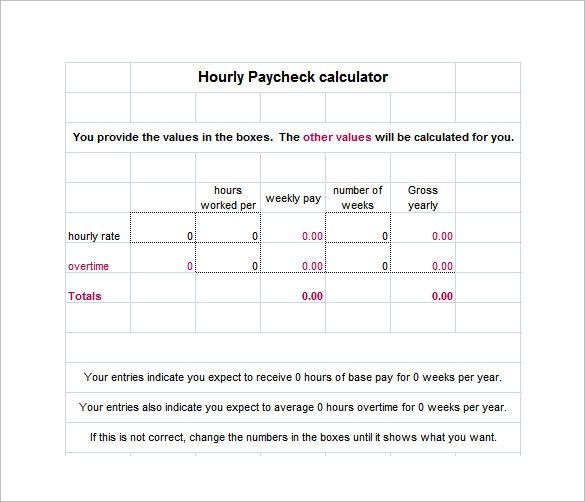

The algorithm behind this hourly paycheck calculator applies the formulas explained below. It can be used for the. -Total gross pay.

For example if an employee earns 1500. 365 days in the year please use 366 for leap years Formula. Of overtime hours Overtime rate per hour.

Annual Salary Bi-Weekly Gross 14 days. Annual salary AS HR WH 52 weeks in a year. Gross Pay Hours Hourly Wage Overtime Hours Hourly Wage 15 Commission Bonuses.

Required net monthly pay. Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. Need to start with an employees net after-tax pay and work your way back to gross pay. Your taxcode if you know it.

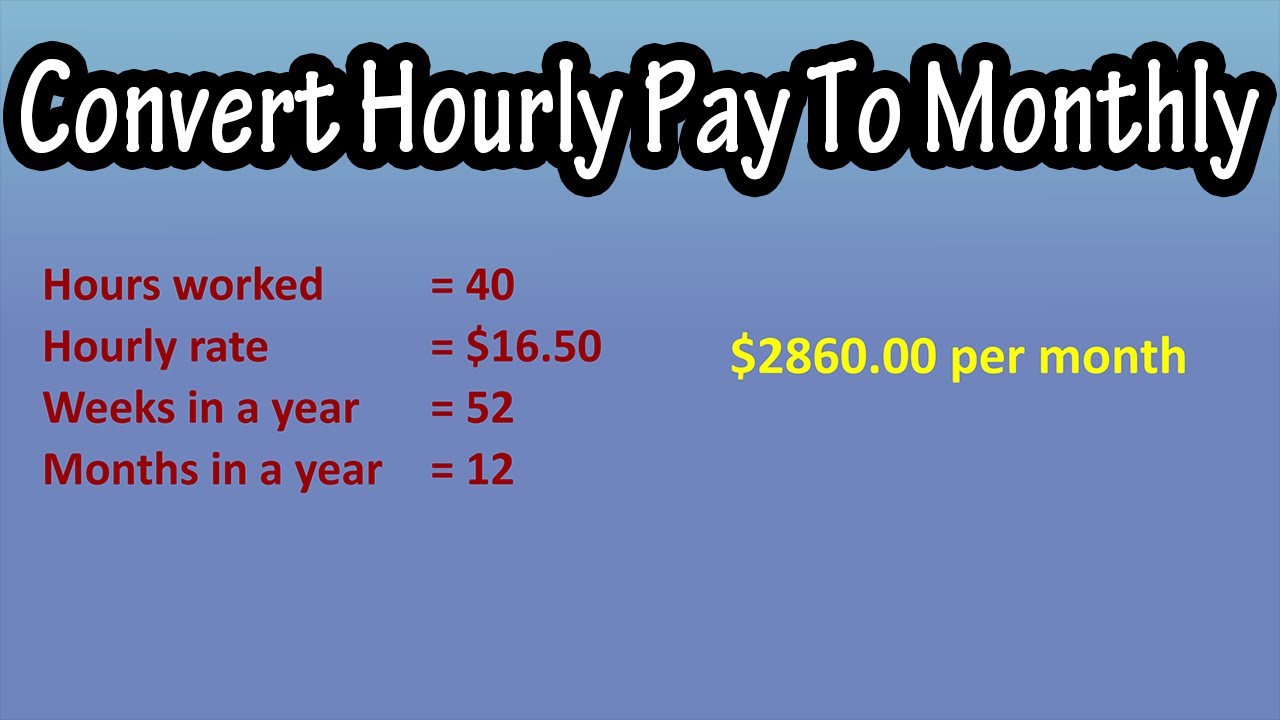

If you have a monthly. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. To calculate the hourly rate on the basis of your monthly salary firstly multiply your monthly salary by 12.

How to Convert Monthly Salary to Hourly Pay. You can change the calculation by saving a new Main income. Calculating Annual Salary Using Bi-Weekly Gross.

Use this online calculator to easily calculate the IRR Internal Rate of Return of any investment given the size of the investment and the cash flow per Using the IRR calculation tool is. Or Select a state. A pay period can be weekly fortnightly or monthly.

-Overtime gross pay No. YEAR Net Salary Per Province. To use the net to gross calculator you will be required to provide the following information.

Monthly salary MS AS12. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Use this federal gross pay calculator to gross up wages based on net pay.

How to calculate the hourly rate of salary. To calculate the hourly rate of your earnings divide the total hours worked in a year by the annual earnings. The algorithm behind this hourly to salary calculator applies the formulas provided below.

Student loan plan if relevant. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. 14 days in a bi-weekly pay period.

To stop the auto-calculation you will need to delete. Then divide the resultant value by.

Hourly To Annual Salary Calculator How Much Do I Make A Year

Salary Calculator

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

How To Calculate Convert Monthly Salary Earnings Pay From Hourly Pay Rate Formula Monthly Pay Youtube

Annual Income Calculator

Hourly Paycheck Calculator Step By Step With Examples

3 Ways To Calculate Your Hourly Rate Wikihow

Wages And Salary Calculator

Hourly Rate Calculator Plan Projections

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

Salary To Hourly Calculator

4 Ways To Calculate Annual Salary Wikihow

How To Calculate Payroll For Hourly Employees Sling

Hourly To Salary What Is My Annual Income

Avanti Gross Salary Calculator