Figure mortgage payment

For instance if your monthly payment is 119354 its biweekly counterpart is 55086. Use this refinance calculator to figure out what your new mortgage payments will be if you refinance your mortgage.

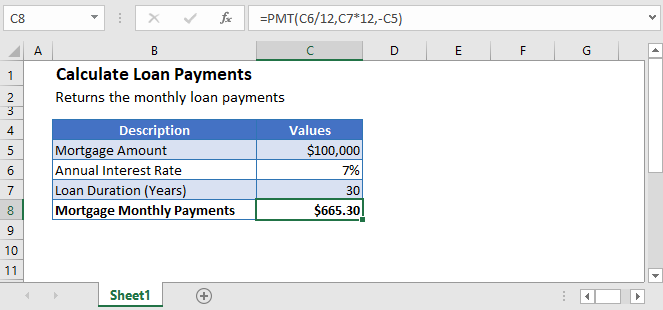

How To Calculate Monthly Mortgage Payment In Excel

One mortgage point typically costs 1 of your loan total for example 2000 on a 200000 mortgage.

. So if youre currently paying 1000 per month in principal and interest payments youd have to pay roughly 1500 per month to cut your loan term in half. The monthly payment amount shown is based on information you provided and is only an estimate. Actual payment could include other amounts such as escrow for insurance and property taxes private mortgage insurance PMI fees and dues.

If you pay additional principal each month your loan or mortgage will be paid earlier than scheduled and you will pay less in interest charges. In addition if you use an accelerated biweekly payment plan you can remove almost 5 years off a 30-year mortgage. And that means if you add just one extra payment per year youll knock years off the term of your mortgagenot to mention interest savings.

Assuming a 20. Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes tied to. Free payment calculator to find monthly payment amount or time period to pay off a loan using a fixed term or a fixed payment.

The accelerated biweekly version will be higher at 59677. The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other. Your principal and interest payments will drop with a smaller.

It does not include other costs of owning a home such as property taxes and insurance. Make Extra House Payments. With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time.

Total of 300 Mortgage Payments. Figure out the monthly payments to pay off a credit card debt. Who Uses Interest Only Loans.

To calculate the monthly payment with PMT you must provide an interest rate the number of periods and a present value which is the loan. Nothing else will be purchased on the card while the debt is being paid off. Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and insurance.

Now lets assume a first-time homebuyer gets buys that less-expensive home and makes a down payment of 20. Compare the monthly payment for different terms rates and loan amounts to figure out what you might be able to afford. Your mortgage payment includes the loan principal interest and other items that the mortgage lender or servicer deposits into an escrow account like taxes and homeowners insurance.

Mortgage lenders need to know that you have enough money coming in to cover all of your bills. The Payment Calculator can help sort out the fine details of such considerations. A mortgage is an example of an annuity.

Use the calculator below to update your estimated monthly. This is the cost of the home minus the down payment. An annuity is a series of equal cash flows spaced equally in time.

Assume that the balance due is 5400 at a 17 annual interest rate. A 30-year fixed-rate loan will give you the lowest payment compared to other shorter-term loans. So if you buy two points at 4000 youll need to write a check for 4000 when.

Start by entering the mortgage amount. If youll be using an adjustable-rate mortgage this amount only applies to the fixed period. Overall mortgage debt tends to grow around 3 to 6 per annum though there can be significant fluctuations in that rate of growth due to factors like BREXIT the global economic crisis which happened in 2008 COVID-19 lockdowns etc.

For example if youre interested in paying off your mortgage off in 15 years as opposed to 30 you generally need a monthly payment that is 15X your typical mortgage payment. Using the function PMTrateNPERPV PMT17122125400 the result is a monthly payment of 26699 to pay the debt off in two years. How to lower your monthly mortgage payment.

Free online mortgage calculator specifically customized for use in Canada including amortization tables and the respective graphs. The attraction of an interest-only loan is that it significantly lowers your initial monthly mortgage payment. To get serious about paying off your mortgage faster here are some ideas to help.

After the Great Depression Fannie Mae was created to add. Make a bigger down payment. This simple mortgage calculator was designed for making side-by-side comparisons of different monthly mortgage payments not including closing costs mortgage insurance or property taxes.

Lets say you have a 220000 30-year mortgage with a 4 interest rate. Use this calculator to figure how much interest you can save by making 12 of your mortgage payment every two weeks instead of a full payment monthly. Choose the longest term possible.

Try one or all of the following tips to get a smaller monthly mortgage payment. The PMT function calculates the required payment for an annuity based on fixed periodic payments and a constant interest rate. See a breakdown of your monthly and total costs including taxes insurance and PMI.

For example lets say youre considering purchasing a 250000 home and putting 20 percent down. Which can be used to pay off the mortgage. That larger down payment helps bring down monthly mortgage payments substantially.

Before the Great Depression many American home buyers used balloon loans they needed to pay off or roll over every 5 years to buy properties. The net effect is just one extra mortgage payment per year but the interest savings can be dramatic. It can also be used when deciding between financing options for a car which can range.

Find financial calculators mortgage rates mortgage lenders insurance quotes refinance information home equity loans credit reports and home finance advice. Also this calculator has the ability to add an extra amount extra payment to the monthly. The accelerated amount is slightly higher than half of the monthly payment.

Your DTI ratio is a percentage that tells lenders how much of your gross monthly income goes to required. Most people need a mortgage to finance a home purchase. Home financial.

Our trusted mortgage payment calculator can help estimate your monthly mortgage payments including estimates for taxes insurance and PMI. Use our free monthly payment calculator to find out your monthly mortgage payment. However putting down less than 20 means youll likely need to pay mortgage insurance and you pay more interest among other things.

This can be difficult to figure out by looking at only your income so most lenders place increased importance on your debt-to-income ratio DTI. Calculate Your Payment.

Excel Formula Calculate Original Loan Amount Exceljet

Mortgage Payment Calculator Calculate Your Ideal Payment Mortgage Payment Calculator Mortgage Payment Mortgage

4 Ways To Calculate Mortgage Payments Wikihow Mortgage Payment Calculator Mortgage Payment Mortgage

How To Calculate Your Monthly Mortgage Payment Given The Principal Interest Rate Loan Period Youtube

Use The Pmt Function To Calculate Mortgage Payments And Cost Of Financing Youtube

Excel Formula Estimate Mortgage Payment Exceljet

Mortgage Repayment Calculator

Extra Payment Mortgage Calculator For Excel

Mortgage Calculator How To Calculate Your Monthly Payments Valuepenguin

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Simple Mortgage Calculator Template Formidable Forms

Calculate Loan Payments In Excel Google Sheets Automate Excel

:max_bytes(150000):strip_icc()/dotdash-INV-final-Ways-to-Be-Mortgage-Free-Faster-Apr-2021-01-43a0ae096f8542a081344ba976221702.jpg)

Ways To Be Mortgage Free Faster

How To Calculate A Mortgage Payment Amount Mortgage Payments Explained With Formula Youtube

How To Calculate Loan Payments Using The Pmt Function In Excel Youtube

Loan Amortization Calculator

Mortgage Calculator How Much Monthly Payments Will Cost